RegTech Market Size, Growth, and Trends Report 2025-2033

Market Overview:

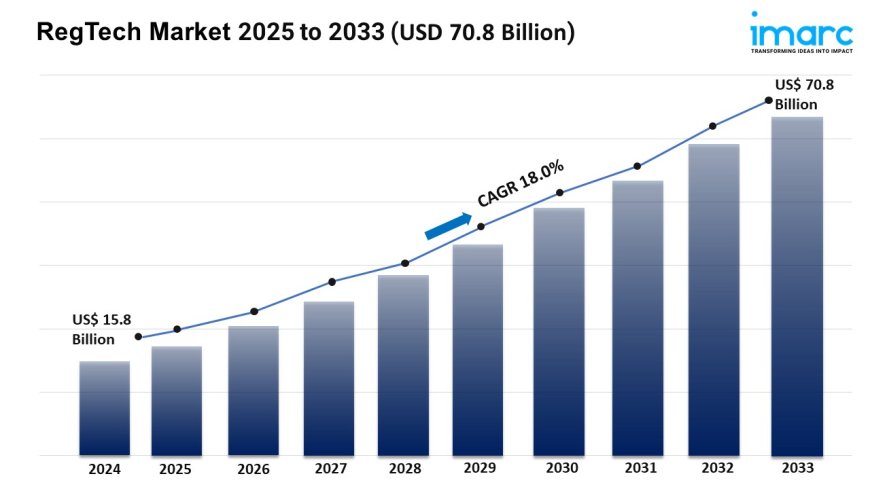

The RegTech market is experiencing rapid growth, driven by increasing regulatory complexity, rising fraud and cyber threats, and demand for cost-effective compliance. According to IMARC Group's latest research publication, "RegTech Market Size, Share, Trends, and Forecast by Component, Deployment Mode, Enterprise Size, Application, End User, and Region, 2025-2033?", the global RegTech market size was valuedatUSD 15.8 Billionin 2024. Looking forward, IMARC Group estimates the market to reachUSD 70.8 Billionby 2033, exhibiting aCAGR of 18.0%from 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report:https://www.imarcgroup.com/regtech-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the RegTech Market

- Increasing Regulatory Complexity

The global RegTech market size in 2024 is expanding due to the growing complexity of regulatory frameworks across industries, particularly in finance. Governments and regulatory bodies worldwide are introducing stricter rules to combat financial crimes like money laundering and ensure data privacy, such as the GDPR in Europe. These regulations demand robust compliance solutions, pushing businesses to adopt RegTech tools to streamline processes. For example, financial institutions face challenges in meeting anti-money laundering (AML) requirements, which involve monitoring vast transaction volumes. RegTech solutions, leveraging automation and analytics, help firms manage these obligations efficiently, reducing the risk of penalties and reputational damage. This complexity drives demand for scalable, technology-driven compliance solutions, fueling market growth.

- Rising Fraud and Cyber Threats

The surge in fraudulent activities and cyber threats is a significant driver for the RegTech market size in 2025. With digital transactions soaring, financial crimes like phishing and identity theft are on the rise. For instance, a 2022 LexisNexis report highlighted a sharp increase in fraud costs for financial institutions, underscoring the need for advanced detection tools. RegTech platforms, equipped with artificial intelligence (AI) and real-time monitoring, enable organizations to identify suspicious activities swiftly. Companies like Chainalysis provide blockchain-based solutions to track illicit cryptocurrency transactions, helping firms stay ahead of sophisticated threats. This growing need for proactive fraud prevention is a key catalyst for RegTech adoption globally.

- Demand for Cost-Effective Compliance

Businesses are increasingly seeking cost-effective ways to manage compliance, boosting the global RegTech market size in 2024. Traditional manual compliance processes are labor-intensive and costly, often requiring large teams to handle regulatory reporting. RegTech solutions automate tasks like know-your-customer (KYC) checks and regulatory reporting, reducing operational costs. For example, ComplyAdvantage offers real-time risk management tools that streamline compliance for fintech firms, cutting down on manual errors and expenses. As organizations prioritize efficiency, especially in resource-constrained environments, RegTechs ability to deliver scalable, automated solutions is driving its adoption across large enterprises and small businesses alike, ensuring sustained market growth.

Key Trends in the RegTech Market

- Adoption of Artificial Intelligence and Machine Learning

A prominent trend shaping the RegTech market size in 2025 is the widespread adoption of AI and machine learning (ML). These technologies enhance the ability of RegTech platforms to analyze vast datasets, detect anomalies, and predict compliance risks in real time. For instance, IBMs cognitive fraud prevention solution, recognized in 2019 for its innovation, uses AI to adapt to evolving fraud patterns, helping financial institutions stay compliant. AI-driven tools also improve regulatory reporting by automating data analysis and reducing errors. As businesses face dynamic regulatory landscapes, the integration of AI and ML into RegTech solutions is transforming compliance into a proactive, data-driven process.

- Growth of Cloud-Based Solutions

Cloud-based RegTech solutions are gaining traction in the global RegTech market size in 2024 due to their scalability and flexibility. Unlike on-premises systems, cloud platforms allow businesses to access real-time regulatory updates and manage compliance without heavy infrastructure investments. For example, in 2021, Broadridge Financial Solutions acquired cloud-based compliance assets to enhance its offerings for broker-dealers. These solutions enable seamless data access, lower maintenance costs, and support remote operations, which became critical during the COVID-19 pandemic. The shift to cloud-based deployments is a key trend, as businesses prioritize cost-efficient, adaptable technologies to navigate complex regulatory environments.

- Blockchain for Enhanced Transparency

Blockchain technology is emerging as a transformative trend in the RegTech market size in 2025, offering secure, tamper-proof records for regulatory compliance. Its ability to ensure data integrity is critical for financial institutions handling sensitive transactions. For instance, in 2024, Hummingbird acquired LogicLoop to strengthen its blockchain-based financial crime risk management platform, enhancing transparency in compliance processes. Blockchain supports applications like AML monitoring and secure identity verification, ensuring compliance with data privacy laws like GDPR. As industries seek immutable solutions to combat fraud and streamline reporting, blockchains role in RegTech is expanding, driving innovation and market growth.

Leading Companies Operating in the Global RegTech Industry:

- ACTICO GmbH

- Acuant Inc.

- Ascent

- Broadridge Financial Solutions Inc.

- ComplyAdvantage

- Deloitte Touche Tohmatsu Limited

- International Business Machines Corporation

- Jumio

- London Stock Exchange Group plc

- MetricStream Inc.

- NICE Ltd.

- PricewaterhouseCoopers

- Thomson Reuters Corporation

- Trulioo

- Wolters Kluwer N.V.

RegTech Market Report Segmentation:

By Component:

- Solution

- Services

Solution represents the largest segment as it encompasses a wide range of tools and technologies, including compliance management software, risk assessment platforms, regulatory reporting systems, and monitoring tools.

By Deployment Mode:

- Cloud-based

- On-premises

On-premises accounts for the majority of the market share due to the concerns surrounding data privacy and sovereignty across various industries.

By Enterprise Size:

- Large Enterprises

- Small and Medium-sized Enterprises

Large enterprises hold a 65.0% market share in 2024, utilizing RegTech to manage vast data volumes, enhance efficiency, and improve customer experiences with advanced technologies like AI and big data analytics.

By Application:

- Anti-Money Laundering (AML) and Fraud Management

- Regulatory Intelligence

- Risk and Compliance Management

- Regulatory Reporting

- Identity Management

Risk and compliance management leads with a 40.8% market share in 2024, driven by AI and ML technologies that enhance real-time threat detection and automate compliance processes.

By End User:

- Banks

- Insurance Companies

- FinTech Firms

- IT and Telecom

- Public Sector

- Energy and Utilities

- Others

Banks dominate with a 22% market share in 2024, using RegTech solutions for compliance management, transactional security, and automation of regulatory reporting to mitigate risks and enhance operational efficiency.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America enjoys the leading position in the market on account of the presence of many RegTech startups and established players, coupled with supportive government initiatives promoting regulatory compliance.

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the worlds most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145